Your First Home in Paradise: A Complete Guide to Buying Your First Home in North Port, Venice, and Englewood, Florida

Your First Home in Paradise: A Complete Guide to Buying Your First Home in North Port, Venice, and Englewood, Florida

The dream of owning your first home in Southwest Florida has never been more attainable. While national headlines focus on market uncertainty, savvy first-time buyers in North Port, Venice, and Englewood are discovering unprecedented opportunities in 2025. With median home prices declining, down payment requirements dropping significantly, and new assistance programs launching, the stars are aligning for those ready to make their Florida homeownership dreams a reality.

If you've been waiting for the "perfect time" to buy your first home in Southwest Florida, that time might be right now. The market has shifted dramatically from the bidding wars of 2021-2022 to a more balanced, buyer-friendly environment where negotiation power has returned to purchasers. This comprehensive guide will walk you through everything you need to know about buying your first home in this beautiful region, from understanding current market conditions to navigating available assistance programs.

Current Market Conditions: Why 2025 is Different for First-Time Buyers in Southwest Florida

The Southwest Florida real estate market has undergone a remarkable transformation in 2025, creating conditions that strongly favor first-time homebuyers. Unlike the frenzied seller's market of recent years, today's environment offers breathing room, choice, and genuine opportunities for negotiation.

North Port Market Snapshot

In North Port, one of the region's most affordable markets for first-time buyers, the median home price has dropped to $307,000 as of June 2025, representing a 9% year-over-year decrease. This price point puts homeownership within reach for many first-time buyers, especially when combined with the dramatic reduction in down payment requirements. The median down payment in North Port has fallen by an impressive 32.4% year-over-year to just $19,958, making the initial financial barrier significantly lower than in previous years.

The broader Southwest Florida market tells a similar story of opportunity. In Cape Coral and Fort Myers, prices have declined 11% over the past two years, with an astounding 50% of listings experiencing price cuts. This widespread price reduction activity indicates sellers' willingness to negotiate and work with buyers to close deals, a stark contrast to the take-it-or-leave-it attitude that characterized the peak market years.

Venice and Englewood present equally compelling opportunities for first-time buyers. In the Venice area (ZIP code 34293), median home prices have decreased 6.8% year-over-year to $400,000, while homes are spending an average of 81 days on the market. This extended market time gives buyers the luxury of careful consideration and thorough due diligence, rather than the rushed decisions that characterized the peak market.

The inventory surge across Southwest Florida has created what industry professionals are calling a "summer of love" for buyers, though not in the traditional sense. Instead of competing against multiple offers, today's first-time buyers enjoy a record number of home options and sellers who are genuinely motivated to negotiate. This shift represents a fundamental change in market dynamics that smart buyers are leveraging to their advantage.

Interest Rates and Financing: The Numbers That Matter for First-Time Buyers

Interest rates have become a crucial factor in the first-time buyer equation, and the news is encouraging for those ready to act. The average 30-year fixed mortgage rate has dropped to 6.58%, marking the lowest level seen throughout 2025. While this rate remains higher than the historic lows of 2020-2021, it represents a meaningful improvement that translates to real savings for homebuyers.

Financial experts predict potential further rate reductions as we approach the end of 2025, but this forecast comes with an important caveat for first-time buyers. Lower interest rates typically trigger increased buyer demand, which can drive both prices and competition higher. This creates a strategic timing consideration: buyers who act now can secure properties in a less competitive environment, while those who wait for lower rates may find themselves competing against more buyers for fewer available homes.

The financing landscape for first-time buyers has also improved through enhanced loan programs and assistance options. Conventional loan requirements remain accessible, with many lenders offering first-time buyer programs that require as little as 3% down. FHA loans continue to provide an excellent option for buyers with limited down payment funds, requiring just 3.5% down and accepting credit scores as low as 580 in many cases.

Local lenders in Southwest Florida have also adapted their programs to meet the needs of the region's diverse buyer population. Many offer specialized programs for relocating buyers, understanding that a significant portion of Southwest Florida's first-time buyers are moving from other states to take advantage of Florida's favorable tax environment and lifestyle benefits.

The Hometown Heroes Program: Up to $35,000 in Free Money for Qualified First-Time Buyers

Hometown Heroes Program Highlights

Launch Date: August 18, 2025

Total Funding: $50 million

Maximum Assistance: $35,000 in zero-interest, forgivable down payment assistance

Eligible Participants: Teachers, firefighters, law enforcement, healthcare workers, military personnel, veterans

Success Rate: Over 20,000 Floridians helped since 2022

One of the most significant developments for first-time buyers in Southwest Florida is the relaunch of the Hometown Heroes Housing Program on August 18, 2025. This state-funded initiative has allocated $50 million to assist qualified first-time buyers, representing a substantial commitment to supporting homeownership among Florida's essential workers and veterans.

The program offers up to $35,000 in zero-interest, forgivable down payment assistance to eligible first-time buyers. This assistance can be the difference between renting indefinitely and achieving homeownership, particularly in markets like North Port, Venice, and Englewood where every dollar of down payment assistance significantly impacts affordability.

Eligibility for the Hometown Heroes program extends to a broad range of essential workers, including teachers, firefighters, law enforcement officers, healthcare workers, military personnel, and veterans. The program has recently expanded income limits, particularly benefiting buyers in higher-cost counties like Collier County, making the assistance accessible to more middle-income families.

Since its inception in 2022, the Hometown Heroes program has successfully helped over 20,000 Floridians achieve homeownership, demonstrating the program's effectiveness and the state's commitment to supporting first-time buyers. The program's structure as forgivable assistance means that buyers who remain in their homes for the required period will never need to repay the funds, making it essentially free money for qualified participants.

For first-time buyers in Southwest Florida, the Hometown Heroes program can be combined with other financing options to create powerful purchasing power. A buyer using the maximum $35,000 assistance on a $307,000 home in North Port would need to finance only $272,000, dramatically reducing both the required down payment and monthly mortgage payments.

North Port: The Affordable Gateway to Southwest Florida Living

North Port stands out as perhaps the most accessible entry point for first-time buyers seeking Southwest Florida's coveted lifestyle. With a median home price of $307,000 and an average home size of 1,649 square feet, North Port offers genuine value in a region where affordability can be challenging.

The city's housing stock, averaging 23 years in age, provides buyers with a mix of established neighborhoods and newer developments. This variety allows first-time buyers to choose between move-in ready homes and properties that might benefit from updates, depending on their budget and renovation appetite. The relatively newer construction means buyers can expect modern amenities and building standards while avoiding the premium prices associated with brand-new construction.

North Port's market fundamentals remain strong, with only 1.18% of homes seriously underwater and 31.02% of properties considered equity-rich. These statistics indicate a stable market where buyers can feel confident about their investment's long-term prospects. The low foreclosure activity, with just 16 filings in June 2025, further demonstrates market stability and suggests that current price levels are sustainable.

The city's location provides easy access to both employment centers and recreational opportunities. North Port residents enjoy proximity to Sarasota's cultural amenities, Venice's beaches, and the broader Southwest Florida job market while benefiting from a more affordable cost of living than many neighboring communities.

Venice: Coastal Living Within Reach for First-Time Buyers

Venice offers first-time buyers the opportunity to own a piece of Florida's stunning Gulf Coast, with median home prices around $400,000 making coastal living more accessible than in many other Southwest Florida beach communities. The city's unique character, anchored by its historic downtown and beautiful beaches, provides a lifestyle that many buyers find irresistible.

The Venice market has shown encouraging trends for first-time buyers, with homes spending an average of 81 days on the market. This extended marketing time gives buyers the opportunity to thoroughly evaluate properties, conduct proper inspections, and negotiate favorable terms without the pressure of immediate decision-making that characterized previous market cycles.

Venice's appeal extends beyond its beaches to include excellent schools, a vibrant arts community, and a strong sense of place that attracts buyers seeking more than just a house. The city's commitment to preserving its character while accommodating growth creates a stable environment for long-term homeownership.

For first-time buyers, Venice represents an opportunity to establish roots in a community with strong property values and desirable amenities. The city's beaches, cultural events, and recreational opportunities provide a lifestyle that many buyers find justifies the premium over inland communities like North Port.

Englewood: The Hidden Gem for Value-Conscious First-Time Buyers

Englewood presents perhaps the best value proposition for first-time buyers in Southwest Florida, with typical single-family homes ranging from $380,000 to $400,000. This pricing puts Englewood in the sweet spot for buyers who want coastal proximity without the premium prices of more established beach communities.

The community's location provides easy access to both Sarasota and Charlotte County amenities while maintaining a more relaxed, small-town atmosphere. Englewood's beaches, including the pristine Englewood Beach and nearby Manasota Key, offer the Florida coastal lifestyle that draws so many buyers to the region.

Englewood's market characteristics make it particularly attractive for first-time buyers who prioritize value and potential appreciation. The area's ongoing development and infrastructure improvements suggest strong long-term prospects, while current pricing remains accessible for buyers with moderate incomes and down payment capabilities.

The community's mix of established neighborhoods and newer developments provides options for buyers with varying preferences and budgets. Whether seeking a move-in ready home or a property with renovation potential, first-time buyers can find suitable options in Englewood's diverse housing stock.

Essential Tips for First-Time Buyers in Southwest Florida

Successfully navigating the Southwest Florida real estate market as a first-time buyer requires understanding both the opportunities and the unique considerations of the region. The current market conditions create advantages for prepared buyers, but success still depends on proper planning and execution.

Start by getting pre-approved for financing before beginning your home search. In today's market, sellers want to work with buyers who can demonstrate their ability to close, and a pre-approval letter provides that assurance. Work with a local lender who understands Southwest Florida's market conditions and can guide you through available assistance programs like Hometown Heroes.

Consider the total cost of homeownership beyond the purchase price. Southwest Florida's insurance requirements, particularly for properties in flood-prone areas, can significantly impact your monthly housing costs. Factor in homeowners insurance, flood insurance if required, property taxes, and HOA fees when calculating affordability.

Take advantage of the current market's extended timelines to conduct thorough due diligence. Unlike the rushed decisions of peak market years, today's buyers can properly inspect properties, research neighborhoods, and negotiate repairs or concessions. Use this time to ensure you're making an informed decision about what will likely be your largest financial investment.

Work with a local real estate agent who specializes in first-time buyers and understands the Southwest Florida market. An experienced agent can help you navigate assistance programs, identify properties that meet your needs and budget, and negotiate effectively in the current market environment.

Don't let perfect be the enemy of good when it comes to your first home purchase. The current market offers excellent opportunities for first-time buyers, but waiting for ideal conditions may mean missing out on today's advantages. Focus on finding a home that meets your current needs and budget, with the understanding that homeownership is typically a long-term investment that builds wealth over time.

The Time to Act is Now: Your Southwest Florida Dream Home Awaits

The convergence of favorable market conditions, assistance programs, and inventory availability has created a unique window of opportunity for first-time buyers in North Port, Venice, and Englewood. While no one can predict future market movements with certainty, the current environment offers advantages that may not persist indefinitely.

The combination of declining prices, reduced down payment requirements, available assistance programs, and motivated sellers creates a compelling case for action. First-time buyers who are financially prepared and ready to move forward have the opportunity to secure their piece of Southwest Florida paradise under conditions that strongly favor purchasers.

The market's shift from the frenzy of recent years to today's more balanced environment means you can make thoughtful, informed decisions without the pressure of immediate competition. This breathing room allows for proper due diligence, careful consideration of options, and negotiation of favorable terms.

Your dream of homeownership in Southwest Florida doesn't have to wait for permission from market headlines or predictions about future conditions. The opportunity exists today for qualified, prepared buyers to take advantage of current market dynamics and assistance programs.

Ready to Start Your First-Time Buyer Journey in Southwest Florida?

As a seasoned expert in Southwest Florida real estate, specializing in the North Port, Venice, and Englewood markets, I understand the unique opportunities and challenges facing first-time buyers in our region. My commitment is to provide you with the empathetic guidance, educational insights, and market expertise you need to make informed decisions about your homeownership journey.

I review market data daily to ensure my clients have access to the most current information about pricing trends, inventory levels, and emerging opportunities. Whether you're exploring the Hometown Heroes program, evaluating different neighborhoods, or ready to start viewing properties, I'm here to support you every step of the way.

The current market conditions won't last forever, and the best opportunities often go to buyers who are prepared to act when conditions align in their favor. If you're ready to explore your options as a first-time buyer in Southwest Florida, I invite you to reach out for a personalized consultation where we can discuss your specific situation, goals, and the strategies that will help you achieve homeownership in this beautiful region.

Get Your Free Buyer ConsultationReady to explore your first-time buyer options in North Port, Venice, or Englewood? Contact me for a personalized market analysis and buyer consultation tailored to your specific needs and goals.

Southwest Florida Real Estate Trends and Buyer Insights - William Bambrick, P.A. | Bambricksellsflorida.com

Categories

- All Blogs (381)

- Aging Parents (2)

- Best Realtor (2)

- Buyers Tips (43)

- Condos (2)

- Downsizing (8)

- Equity (5)

- FAQ (1)

- Financing/Mortgage (8)

- First Time Home Buyers (15)

- Fun Items (6)

- Heron Creek (1)

- Home Remodeling (7)

- homes near golf courses (1)

- Investing (4)

- Living In North Port (5)

- Local Housing Market (50)

- luxury homes (3)

- Making Offers (8)

- Moving (6)

- Multigenerational (5)

- New Construction (3)

- Nokomis Florida (1)

- Nokomis Housing Report (1)

- North Port Florida (3)

- North Port Housing Report (5)

- Pool Homes (3)

- Port Charlotte Florida, (2)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Rotunda West (2)

- Sellers (51)

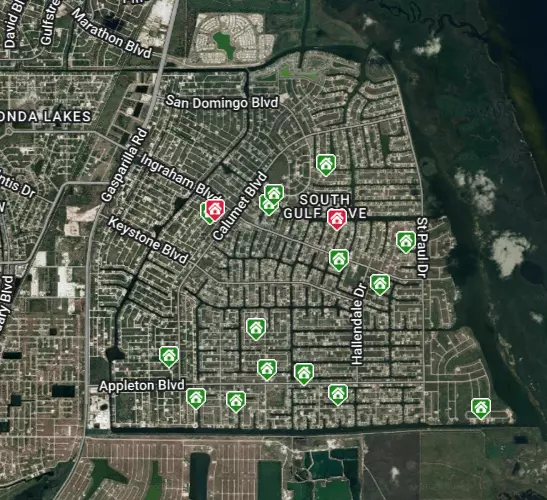

- south gulf cove (2)

- Thing to Do in the Area (8)

- Venice Housing Report (4)

- Venice, Florida (2)

- Waterfront Homes (2)

- Wellen Park (1)

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "