Why Is Housing Inventory So Low?

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.There aren’t enough homes available for sale, but that

Read More

Insights to the Rest of Year in Housing

Read More

Two Questions To Ask Yourself if You’re Considering Buying a Venice Florida Home

If you’re thinking of buying a home in Venice Florida, chances are you’re paying attention to just about everything you hear about the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved

Read More

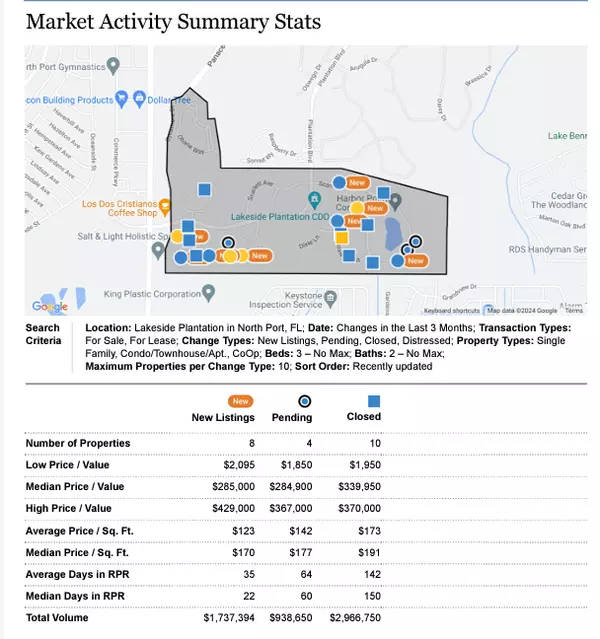

Market Report - North Port 34286 May 2023

This is a real-time market report for 34286 in North Port Florida. Like any data, it needs to be curated to your specific home. No two homes are the same but many facets can be, like fixtures, mechanical, and design elements. New home builders are able to offer all the check boxes buyers want at

Read More

![Reasons To Own Your Sarasota Area Home [INFOGRAPHIC],Bill Bambrick - Sarasota Realtor](https://cdn.chime.me/image/fs/cmsbuild/202363/15/w600_original_b98a5a31-ecdc-4b78-8808-0f91190b996f-png.webp)

Reasons To Own Your Sarasota Area Home [INFOGRAPHIC]

Some Highlights June is National Homeownership Month, and it’s a perfect time to think about all the benefits that come with owning your Sarasota area home. Owning a home not only makes you feel proud and accomplished, but it’s also a big step toward having a secure and stable financial future. A

Read More

The Benefits of Selling Now, According to Experts

Venice Florida Home Owners, if you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale in Venice. And, with so f

Read More

Top 3 Things to Sell Your North Port Florida Home

Read More

What Does it Mean to Be in a Sellers Market?

Read More

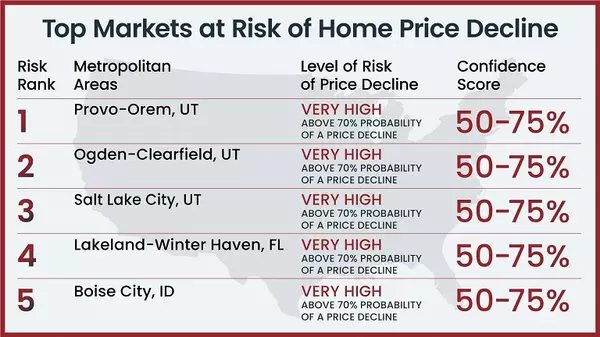

Top Five Markets at Risk for Home Price Declines

Read More

Why Aren’t Home Prices Crashing?

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a home. And after several years of rapid price appreciation, home prices finally peaked last summer. These changes led to a rise in headlines saying pric

Read More

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving. A recent survey from realtor.com asked why homeowners are thinking about selling their houses this year. Here are the top two reasons (see graphic below):Let’s break th

Read More

Just Listed in North Port

7910 Jeffery Ave, North Port, Florida Maps & Local Schools Print Click Here to Get Directions $179,900 2bed - 1bath - 7525 sqft lot This charming move-in-ready home is the perfect starter home. Enjoy the terrazzo floors with some covered with other materials ready for a transformation. Th

Read More

How Homeownership Is Life Changing for Many Women

Throughout Women’s History Month, we reflect on the impact women have in our lives, and that includes impact on the housing market. In fact, since at least 1981, single women have bought more homes than single men each year, and they make up 17% of all households.Why Is Homeownership So Important to

Read More

Why Buying a North Port Home Is a Sound Decision

If you’re thinking about buying a North Port home, you want to know the decision will be a good one. And for many, that means thinking about what home prices are projected to do in the coming years and how that could impact your investment. The City of North Port has seen fantastic growth over the

Read More

Look at the Big Picture When it Comes to Home Prices - Video

Read More

What’s Ahead for Sarasota Home Prices in 2023

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could see slight appreciation or depreciation depending on the area o

Read More

Here’s Why the Housing Market Isn’t Going To Crash

Read More

What Buyer Activity Tells Us About the Housing Market

Though the housing market is no longer experiencing the frenzy of a year ago, buyers are showing their interest in purchasing a home. According to U.S. News:“Housing markets have cooled slightly, but demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on

Read More

An Expert Gives You Clarity in Today’s Sarasota Housing Market

The Sarasota housing market has been going through shifts lately. That’s why it’s so important to work with an industry professional like Bill Bambrick with LPT Realty who can be your guide throughout the process. A real estate expert like Bill Bambrick uses their knowledge of what’s really happeni

Read More

Categories

- All Blogs (335)

- Aging Parents (2)

- Buyers Tips (38)

- Condos (2)

- Downsizing (7)

- Equity (5)

- Financing/Mortgage (7)

- First Time Home Buyers (7)

- Fun Items (4)

- Home Remodeling (4)

- Investing (4)

- Local Housing Market (39)

- Making Offers (4)

- Moving (2)

- Multigenerational (4)

- New Construction (1)

- North Port Housing Report (3)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Sellers (37)

- Thing to Do in the Area (4)

- Venice Housing Report (1)

Recent Posts