What’s Next for Home Prices and Mortgage Rates?

If you’re thinking of making a move this year, there are two housing market factors that are probably on your mind: home prices and mortgage rates. You’re wondering what’s going to happen next. And if it’s worth it to move now, or better to wait it out.The only thing you can really do is make the be

Read More

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC],KCM Crew](https://img.chime.me/image/fs/chimeblog/20240427/16/original_a1bcec26-0b8b-4cfa-bd52-043dfb7de683.png)

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

Some HighlightsDid you know the equity you have in your current house can help make your move possible?Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer. The typical homeowner has $298,000 in equi

Read More

Why We Aren't Headed for a Housing Crash

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say home prices are going to keep going up.Today’s market is very different than it was before the

Read More

Here’s Why the Housing Market Isn’t Going To Crash

Read More

Leverage Your Equity When You Sell Your Venice Florida House

One of the benefits of being a homeowner is that you build equity over time. By selling your Venice Florida house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like thi

Read More

Categories

- All Blogs (335)

- Aging Parents (2)

- Buyers Tips (38)

- Condos (2)

- Downsizing (7)

- Equity (5)

- Financing/Mortgage (7)

- First Time Home Buyers (7)

- Fun Items (4)

- Home Remodeling (4)

- Investing (4)

- Local Housing Market (39)

- Making Offers (4)

- Moving (2)

- Multigenerational (4)

- New Construction (1)

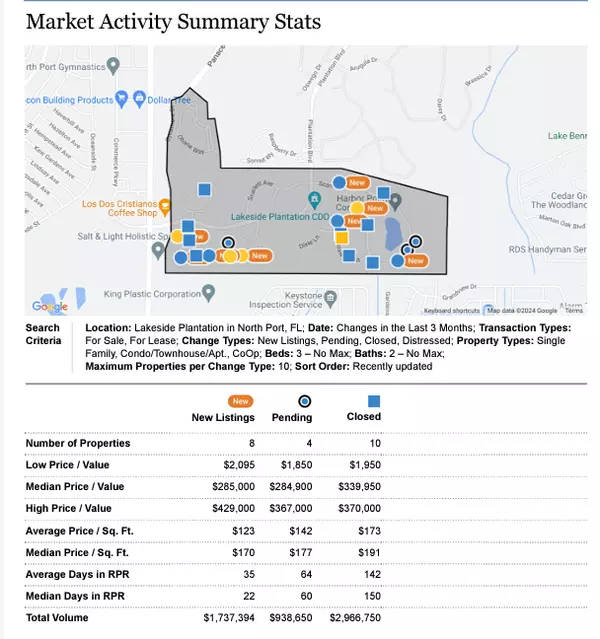

- North Port Housing Report (3)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Sellers (37)

- Thing to Do in the Area (4)

- Venice Housing Report (1)

Recent Posts