Best Recession Proof Markets in 2023

https://www.biggerpockets.com/blog/best-recession-proof-markets

Choosing the right real estate investment to add to your portfolio requires ample research and extensive knowledge about the market that you’re investing in. A poor decision can result in your portfolio dropping substantially in value. When markets start to dip, and the economy enters a recession, selecting the best investment becomes even more important.

The most rewarding investments are ones that occur in recession-proof markets, which are areas where homes are in high demand regardless of how the economy is performing. Not every market performs the same. By investing your money in homes that are situated in recession-proof markets, you can benefit from consistent rental income, moderate appreciation even in poor economic environments, and continued rental increases YoY.

Why Now Is a Great Time to Invest

The recent market trends indicate that 2023 is a good time to invest in real estate as long as you focus on the right markets. In recent months, interest rates have continued to increase. However, these increases have slowed and may come to a stop by the end of this year. Buyer demand is also slowing down, which makes it easier for you to invest in real estate without needing to make numerous bids before having one accepted.

While the current state of the economy is adversely affecting the real estate market as a whole, there are some individual markets that appear to be recession-proof, which means that they will continue to perform well compared to the national housing market.

When identifying markets that are considered to be recession-proof, there are many factors that should be considered, which include everything from the average sale price to the population numbers. The following offers a comprehensive overview of five of the top recession-proof markets you can invest in throughout 2023.

Kansas City, Missouri

As the largest city in Missouri, Kansas City has long been a popular destination among California residents as well as people who are moving from other large Midwest cities. There are numerous pieces of data and statistics that point towards Kansas City being recession-proof. For instance, the median sale price in the city has continued to increase, which means that buyer demand isn’t dropping like it is in cities and towns that aren’t recession-proof.

In every real estate market, home prices usually reach their highest in the late spring and summer months before dipping slightly in the winter months when not many buyers are on the market. While this is also the case in Kansas City, the median sale price has been trending higher for a lengthy period of time. The median sale price as of 2023 is $230,000, which is a YoY increase of around 7%. In June 2022, the median sale price was $285,000.

Throughout the coming months, home values in Kansas City should increase since there are no signs that the current economic climate is impacting the local real estate market. Even though homes have become more expensive in Kansas City, the median price of $230,000 is highly affordable compared to many popular markets throughout the U.S. Keep in mind that rents don’t fall much during recessions, which gives you the opportunity to charge relatively high rents even when you’re able to purchase a property at an affordable price.

In January 2023, more than 400 homes were sold in this market. Home sales usually get close to 1,000 per month during the warm summer months. Over the past few years, home sales in the city have been relatively consistent, which means that the best time of year for you to invest largely depends on what type of property you’re buying and how much competition you’re ready to contend with.

Keep in mind that 28% of homes on the market in January 2023 saw price drops, which was an 11% YoY increase. In this scenario, you have some negotiating power when attempting to obtain a lower sale price. Over the past decade, Kansas City’s population numbers have steadily increased. The current population is well over 500,000 and has increased by more than 50,000 since 2010. If you’re going to be renting out your investment property, you can be confident that there will be a large number of people looking to rent.

Akron, Ohio

Akron is another popular midwest city with affordable home prices that investors can take advantage of. The current median sale price is just under $107,000, which is close to the price that it was at the same time last year. While home values in most cities usually reach their peak in June and July, the home prices in Akron matched the June high in September 2022.

Another sign that Akron is a recession-proof real estate market is that the number of days that homes have remained on the market before being sold has been consistent. In January 2022, homes were on the market for an average of 33 days before being sold. One year later, homes are on the market for an average of 34 days before being sold.

When a recession occurs in markets that aren’t recession-proof, it’s common for buyer demand to drop considerably, which leads to home inventory staying on the market for much longer than usual. Even with a recession nearing, Akron’s real estate market is nearly maintaining its performance when interest rates were at their lowest.

Lehigh Acres, Florida

Lehigh Acres is among the strongest real estate markets in the U.S. and is ideal for anyone who’s looking to invest in real estate during 2023. Likely the most obvious sign that the Lehigh Acres real estate market is performing well is the median sale price of more than $327,000, which is nearly 25% higher than the median sale price in January 2022.

Even though home values are typically at their lowest in January, the median price for a home in Lehigh Acres has only been slightly higher in July, August, and October of last year. Home values have risen substantially over the past decade. In January 2018, the median sale price for a home in this city was $165,000, which means that the current sale price is nearly double.

If you’re looking to invest in real estate that will provide you with consistent income, the home you end up investing in should appreciate in value over time because of the overall health of the Lehigh Acres market.

Keep in mind that the population in this city has risen considerably over the past decade and will likely continue to do so in the coming years. In 2011, Lehigh Acres was home to a population of around 92,000. The total population has increased every year and is now situated at just under 125,000. As an investor, more people moving into the city should make it easier for you to find tenants and keep rents high.

Indianapolis, Indiana

Indianapolis is another popular real estate market with affordable home values. As of January 2023, the median sale price for a single-family home in Indianapolis is $215,000, which represents a YoY increase of around 1.5%. In fact, there has yet to be a single month without YoY growth in home values in four years.

Five years ago, the median sale price for a home was a little over $136,000. By investing in the Indianapolis real estate market, you should have peace of mind that your property will appreciate in value over time. Homes only remain on the market for an average of 33 days before being sold, which indicates that there are many buyers and renters on the market. Buyers who can’t afford to purchase a home because of the recession are more likely to rent, which means that you should be able to bring in new tenants without issue.

While all homes are being sold relatively quickly, homes in popular areas of the city go from being listed to pending in just seven days. Like the other cities on this list, the population in Indianapolis has been on a steady incline for the past decade. In 2013, around 844,000 people were living in Indianapolis.

Today, the population is over 900,000 when taking current estimations into account.

Another indication that the market is recession-proof is the expected job growth in the city. The average rate of employment growth in the entirety of Indiana is around 2% in 2023 and 2024. In comparison, Indianapolis is expected to see employment growth of 2.9% for the same two years. Job growth means that more people will be moving into the city and looking to rent.

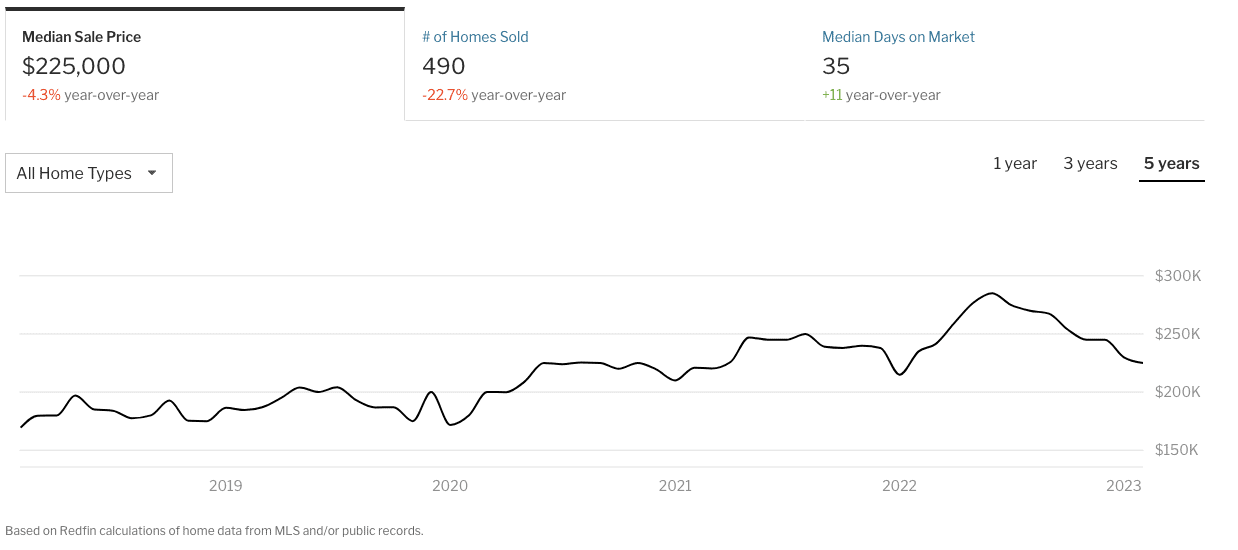

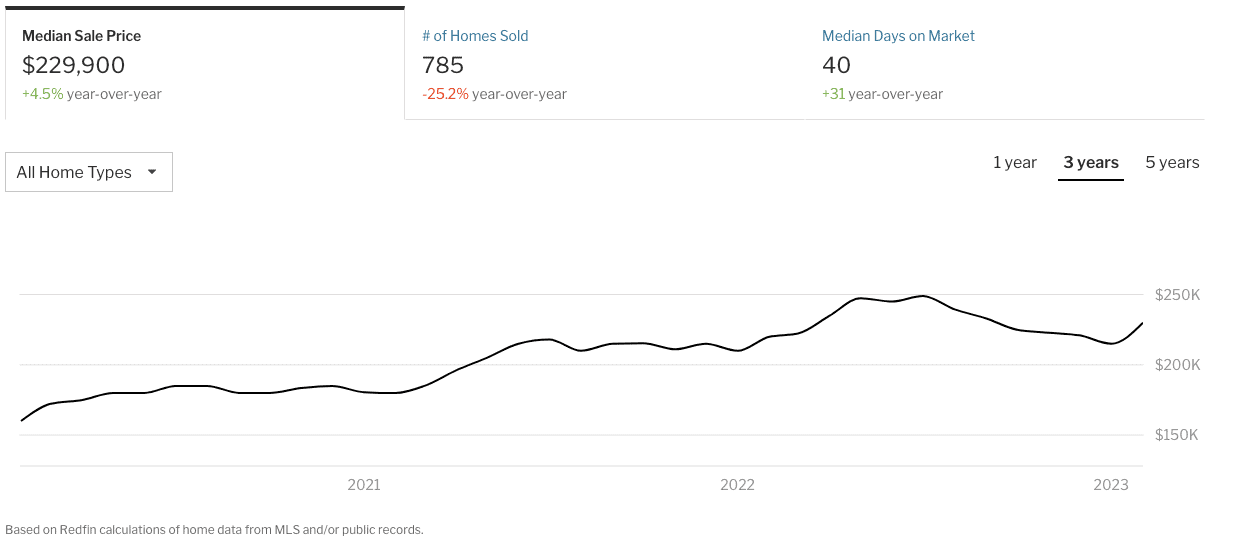

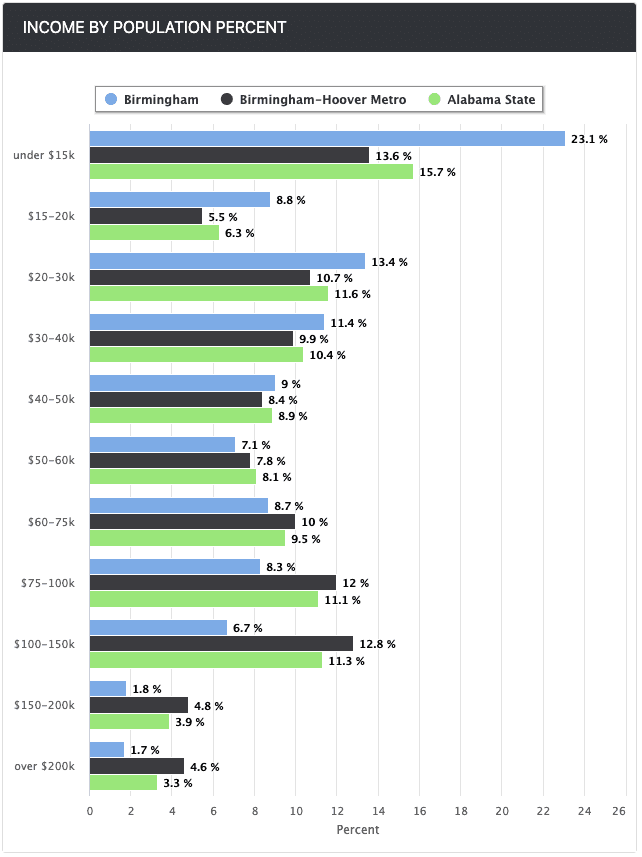

Birmingham, Alabama

If you’re looking to invest in a popular real estate market that also has affordable homes, Birmingham may be the perfect place to look. The median sale price for a single-family home was just under $210,000 in December 2022, which marked a 20.7% increase from the same month in 2021. When you purchase a home in Birmingham, you should receive a property that will increase in value as you hold it.

Keep in mind that real estate is often considered a hedge against inflation. At a time when other investments tend to drop in value, real estate values typically increase. You can also maintain a high income in a recession-proof market because of the ability to charge consistent rents.

The median rent for a one-bedroom apartment in Birmingham is $1,298 as of February 2023, which is a sharp YoY increase of 27%. With this information in mind, you have the opportunity to buy at a low price and rent out the property at a price that’s much higher than the monthly mortgage would be.

One reason why Birmingham is a recession-proof market is because of the constant job growth that the city experiences. Over the past year, the city has had job growth of around 2%. Recent estimates state that job growth in the city during the next decade should be around 29%. Investing in a city with high job growth means that you should be able to avoid tenancy issues. A hot job market typically indicates that the real estate market will also be popular.

Conclusion

Real estate is one type of investment that you don’t need to stop adding to your portfolio when a recession hits. During poor economic times, you may be able to keep your income high and reduce portfolio losses by investing in markets that are considered to be recession-proof.

The five aforementioned markets have all proven to be popular destinations among buyers. When you invest in one of these markets, it’s likely that the value of your property will continue to increase the longer you hold it.

Categories

- All Blogs (385)

- Aging Parents (2)

- Best Realtor (2)

- Buyers Tips (46)

- Condos (2)

- Downsizing (8)

- Equity (5)

- FAQ (2)

- Financing/Mortgage (8)

- First Time Home Buyers (17)

- Fun Items (6)

- Heron Creek (1)

- Home Remodeling (7)

- homes near golf courses (1)

- Investing (4)

- Living In North Port (5)

- Local Housing Market (51)

- luxury homes (3)

- Making Offers (9)

- Moving (6)

- Multigenerational (5)

- New Construction (3)

- Nokomis Florida (1)

- Nokomis Housing Report (1)

- North Port Florida (5)

- North Port Housing Report (7)

- Pool Homes (3)

- Port Charlotte Florida, (2)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Rotunda West (2)

- Sellers (52)

- south gulf cove (2)

- Thing to Do in the Area (8)

- Venice Housing Report (4)

- Venice, Florida (2)

- Waterfront Homes (2)

- Wellen Park (2)

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "