Seller Concessions in Florida Real Estate: Tips and Pitfalls Every Homebuyer Should Know

Seller Concessions in Florida: Tips and Pitfalls Every Homebuyer Should Know

Buying a home in Florida is exciting, but navigating the financial details can feel like a maze. One term you’ll often hear is “seller concessions.” These are incentives or contributions a seller offers to help close the deal—think covering closing costs, prepaid taxes, or even home warranties. While concessions can sweeten the pot for buyers, it’s essential to understand how they work and what to watch out for.

What Are Seller Concessions?

Seller concessions are agreements where the seller agrees to pay for certain costs that would normally fall to the buyer. These might include:

- Loan origination fees

- Appraisal and inspection costs

- Title insurance

- Prepaid taxes and insurance

- Home warranties

In Florida’s competitive market, concessions can help buyers manage upfront expenses and make homeownership more accessible.

Common Types of Seller Concessions in Florida

- Closing Cost Assistance: A seller may agree to pay a portion of the buyer’s closing costs (often capped by loan type).

- Repair Credits: Instead of fixing issues, you may credit the buyer at closing to handle repairs themselves.

- Home Warranty Coverage: Offering a one-year home warranty can give buyers peace of mind.

- Prepaid Items: Covering a few months of HOA dues or property taxes can help close the gap for cash-strapped buyers.

When Should a Seller Consider Offering Concessions?

- Your home has been on the market longer than expected

- The buyer submits a strong offer with minor requests

- The inspection report reveals needed repairs

- You want to protect your timeline and avoid renegotiation

However, offering concessions too early—before the buyer even asks—can weaken your leverage.

Top Tips for Buyers

- Know the Limits: Lenders often cap the amount of concessions allowed—typically 3-6% of the purchase price, depending on loan type. Check with your lender before negotiating.

- Be Strategic: Use concessions to cover non-recurring closing costs or repairs, rather than inflating the purchase price to offset them.

- Work With an Experienced Agent: A savvy Florida real estate agent can help you negotiate concessions that truly benefit you, without jeopardizing your offer’s competitiveness.

- Get Everything in Writing: Make sure all concessions are clearly outlined in your purchase agreement to avoid last-minute surprises.

Tips for Negotiating Smart Concessions

- Work with a skilled real estate agent who understands the Florida market and can advocate for your interests.

- Don’t be afraid to ask for what you need, but be prepared to compromise based on the seller’s situation.

- Focus on win-win solutions that help both sides move forward confidently.

Common Pitfalls to Avoid

- Appraisal Issues: If the sale price is bumped up to cover concessions, the home still needs to appraise for that higher amount. If it doesn’t, you could be left scrambling to cover the difference.

- Seller Resistance: In hot markets, sellers might be less willing to offer concessions. Over-asking can make your offer less appealing.

- Not All Costs Are Eligible: Some fees can’t be covered by concessions, so know what’s allowed under your loan program.

Final Thoughts

Seller concessions can make buying a home in Florida more affordable, but they require careful negotiation and a clear understanding of your loan’s guidelines. By partnering with a knowledgeable agent and staying informed, you can use concessions to your advantage—without falling into common traps.

Why Local Market Insight Matters

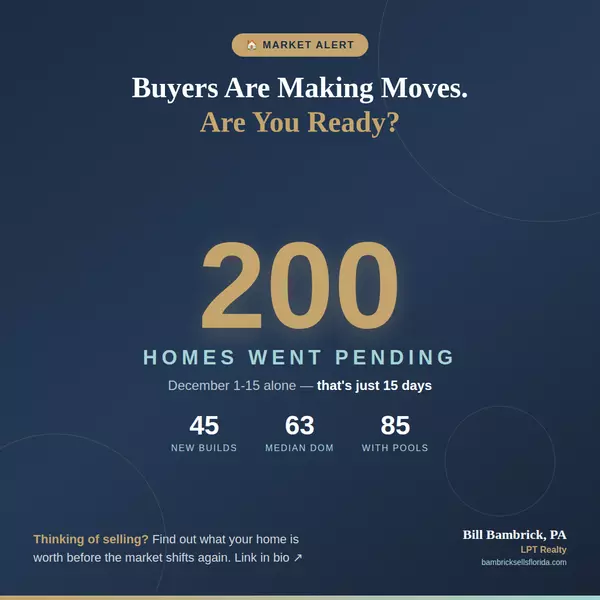

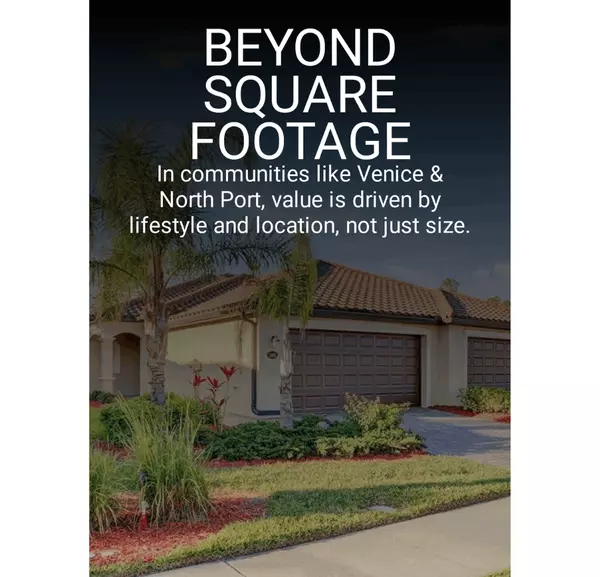

Understanding what’s typical in your local area is key. In Englewood, Venice, or North Port or Wellen Park, what’s expected from sellers can shift quickly depending on inventory, buyer demand, and even the season.

William Bambrick with bambricksellsflorida.com. uses up-to-date market data and proven strategies to help you negotiate strong, fair terms that align with your goals.

Want expert guidance before making a costly concession? Call Bill Bambrick today at 941-218-9961 to discuss your options with a trusted Florida real estate advisor.

Categories

- All Blogs (387)

- Aging Parents (2)

- Best Realtor (2)

- Buyers Tips (46)

- Condos (2)

- Downsizing (8)

- Equity (5)

- FAQ (2)

- Financing/Mortgage (8)

- First Time Home Buyers (17)

- Fun Items (6)

- Heron Creek (1)

- Home Remodeling (7)

- homes near golf courses (1)

- Investing (4)

- Living In North Port (5)

- Local Housing Market (52)

- luxury homes (3)

- Making Offers (9)

- Moving (6)

- Multigenerational (5)

- New Construction (3)

- Nokomis Florida (1)

- Nokomis Housing Report (1)

- North Port Florida (5)

- North Port Housing Report (7)

- Pool Homes (3)

- Port Charlotte Florida, (2)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Rotunda West (2)

- Sellers (52)

- south gulf cove (2)

- Thing to Do in the Area (8)

- Venice Housing Report (4)

- Venice, Florida (2)

- Waterfront Homes (2)

- Wellen Park (2)

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "