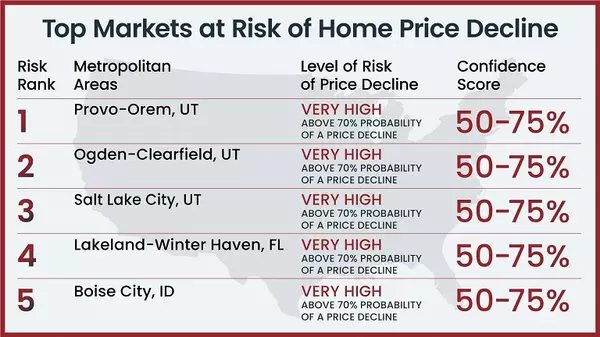

Top Five Markets at Risk for Home Price Declines

Read More

Best Recession Proof Markets in 2023

https://www.biggerpockets.com/blog/best-recession-proof-markets Choosing the right real estate investment to add to your portfolio requires ample research and extensive knowledge about the market that you’re investing in. A poor decision can result in your portfolio dropping substantially in value. When markets start to dip, and the economy enters a recession, selecting the best investment becomes even more important. The most rewarding investments are ones that occur in recession-proof markets, which are areas where homes are in high demand regardless of how the economy is performing. Not every market performs the same. By investing your money in homes that are situated in recession-proof markets, you can benefit from consistent rental income, moderate appreciation even in poor economic environments, and continued rental increases YoY. Why Now Is a Great Time to Invest The recent market trends indicate that 2023 is a good time to invest in real estate as long as you focus on the right markets. In recent months, interest rates have continued to increase. However, these increases have slowed and may come to a stop by the end of this year. Buyer demand is also slowing down, which makes it easier for you to invest in real estate without needing to make numerous bids before having one accepted. While the current state of the economy is adversely affecting the real estate market as a whole, there are some individual markets that appear to be recession-proof, which means that they will continue to perform well compared to the national housing market. When identifying markets that are considered to be recession-proof, there are many factors that should be considered, which include everything from the average sale price to the population numbers. The following offers a comprehensive overview of five of the top recession-proof markets you can invest in throughout 2023. Kansas City, Missouri As the largest city in Missouri, Kansas City has long been a popular destination among California residents as well as people who are moving from other large Midwest cities. There are numerous pieces of data and statistics that point towards Kansas City being recession-proof. For instance, the median sale price in the city has continued to increase, which means that buyer demand isn’t dropping like it is in cities and towns that aren’t recession-proof. Kansas City, Missouri Housing Market Statistics (2018-2023) – Redfin In every real estate market, home prices usually reach their highest in the late spring and summer months before dipping slightly in the winter months when not many buyers are on the market. While this is also the case in Kansas City, the median sale price has been trending higher for a lengthy period of time. The median sale price as of 2023 is $230,000, which is a YoY increase of around 7%. In June 2022, the median sale price was $285,000. Throughout the coming months, home values in Kansas City should increase since there are no signs that the current economic climate is impacting the local real estate market. Even though homes have become more expensive in Kansas City, the median price of $230,000 is highly affordable compared to many popular markets throughout the U.S. Keep in mind that rents don’t fall much during recessions, which gives you the opportunity to charge relatively high rents even when you’re able to purchase a property at an affordable price. In January 2023, more than 400 homes were sold in this market. Home sales usually get close to 1,000 per month during the warm summer months. Over the past few years, home sales in the city have been relatively consistent, which means that the best time of year for you to invest largely depends on what type of property you’re buying and how much competition you’re ready to contend with. Keep in mind that 28% of homes on the market in January 2023 saw price drops, which was an 11% YoY increase. In this scenario, you have some negotiating power when attempting to obtain a lower sale price. Over the past decade, Kansas City’s population numbers have steadily increased. The current population is well over 500,000 and has increased by more than 50,000 since 2010. If you’re going to be renting out your investment property, you can be confident that there will be a large number of people looking to rent. Akron, Ohio Akron is another popular midwest city with affordable home prices that investors can take advantage of. The current median sale price is just under $107,000, which is close to the price that it was at the same time last year. While home values in most cities usually reach their peak in June and July, the home prices in Akron matched the June high in September 2022. Another sign that Akron is a recession-proof real estate market is that the number of days that homes have remained on the market before being sold has been consistent. In January 2022, homes were on the market for an average of 33 days before being sold. One year later, homes are on the market for an average of 34 days before being sold. When a recession occurs in markets that aren’t recession-proof, it’s common for buyer demand to drop considerably, which leads to home inventory staying on the market for much longer than usual. Even with a recession nearing, Akron’s real estate market is nearly maintaining its performance when interest rates were at their lowest. Lehigh Acres, Florida Lehigh Acres is among the strongest real estate markets in the U.S. and is ideal for anyone who’s looking to invest in real estate during 2023. Likely the most obvious sign that the Lehigh Acres real estate market is performing well is the median sale price of more than $327,000, which is nearly 25% higher than the median sale price in January 2022. Even though home values are typically at their lowest in January, the median price for a home in Lehigh Acres has only been slightly higher in July, August, and October of last year. Home values have risen substantially over the past decade. In January 2018, the median sale price for a home in this city was $165,000, which means that the current sale price is nearly double. If you’re looking to invest in real estate that will provide you with consistent income, the home you end up investing in should appreciate in value over time because of the overall health of the Lehigh Acres market. Keep in mind that the population in this city has risen considerably over the past decade and will likely continue to do so in the coming years. In 2011, Lehigh Acres was home to a population of around 92,000. The total population has increased every year and is now situated at just under 125,000. As an investor, more people moving into the city should make it easier for you to find tenants and keep rents high. Indianapolis, Indiana Indianapolis is another popular real estate market with affordable home values. As of January 2023, the median sale price for a single-family home in Indianapolis is $215,000, which represents a YoY increase of around 1.5%. In fact, there has yet to be a single month without YoY growth in home values in four years. Indianapolis, Indiana Housing Market Statistics (2018-2023) – Redfin Five years ago, the median sale price for a home was a little over $136,000. By investing in the Indianapolis real estate market, you should have peace of mind that your property will appreciate in value over time. Homes only remain on the market for an average of 33 days before being sold, which indicates that there are many buyers and renters on the market. Buyers who can’t afford to purchase a home because of the recession are more likely to rent, which means that you should be able to bring in new tenants without issue. While all homes are being sold relatively quickly, homes in popular areas of the city go from being listed to pending in just seven days. Like the other cities on this list, the population in Indianapolis has been on a steady incline for the past decade. In 2013, around 844,000 people were living in Indianapolis. Today, the population is over 900,000 when taking current estimations into account. Another indication that the market is recession-proof is the expected job growth in the city. The average rate of employment growth in the entirety of Indiana is around 2% in 2023 and 2024. In comparison, Indianapolis is expected to see employment growth of 2.9% for the same two years. Job growth means that more people will be moving into the city and looking to rent. Birmingham, Alabama If you’re looking to invest in a popular real estate market that also has affordable homes, Birmingham may be the perfect place to look. The median sale price for a single-family home was just under $210,000 in December 2022, which marked a 20.7% increase from the same month in 2021. When you purchase a home in Birmingham, you should receive a property that will increase in value as you hold it. Keep in mind that real estate is often considered a hedge against inflation. At a time when other investments tend to drop in value, real estate values typically increase. You can also maintain a high income in a recession-proof market because of the ability to charge consistent rents. The median rent for a one-bedroom apartment in Birmingham is $1,298 as of February 2023, which is a sharp YoY increase of 27%. With this information in mind, you have the opportunity to buy at a low price and rent out the property at a price that’s much higher than the monthly mortgage would be. One reason why Birmingham is a recession-proof market is because of the constant job growth that the city experiences. Over the past year, the city has had job growth of around 2%. Recent estimates state that job growth in the city during the next decade should be around 29%. Investing in a city with high job growth means that you should be able to avoid tenancy issues. A hot job market typically indicates that the real estate market will also be popular. Income by Population as a Percentage in Birmingham, Alabama and the State of Alabama – Best Places Conclusion Real estate is one type of investment that you don’t need to stop adding to your portfolio when a recession hits. During poor economic times, you may be able to keep your income high and reduce portfolio losses by investing in markets that are considered to be recession-proof. The five aforementioned markets have all proven to be popular destinations among buyers. When you invest in one of these markets, it’s likely that the value of your property will continue to increase the longer you hold it.

Read More

![The Key Advantage of Investing in a Home [INFOGRAPHIC],KCM Crew](https://cdn.chime.me/image/fs/sitebuild/2019929/2/w600_original_dfefa6fe-eceb-4ecf-aadc-e48589da0a9a-jpeg.webp)

The Key Advantage of Investing in a Home [INFOGRAPHIC]

Read More

Trying To Buy a Home? Hang in There.

We’re still in a sellers’ market. And if you’re looking to buy a home, that means you’re likely facing some unique challenges, like difficulty finding a home and volatile mortgage rates. But keep in mind, there are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them.Long-Term Benefits Outweigh Short-Term ChallengesOwning a home grows your net worth – and since building that wealth takes time, it makes sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity. Freddie Mac puts it this way:“Homeownership not only builds a sense of pride and accomplishment, but it’s also an important step toward achieving long-term financial stability.”The key there is long-term because the financial benefits homeownership provides, like home value appreciation and equity, grow over time. Those benefits are worth the short-term challenges today’s sellers’ market presents.Mortgage Rates Are Constantly ChangingMortgage rates have been hovering around 6.5% over the last several months. However, as Sam Khater, Chief Economist at Freddie Mac, notes, they’ve been coming down some recently:“Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market . . .”Lower mortgage rates improve your purchasing power when you buy, and that can help make homeownership more affordable. Hannah Jones, Economic Data Analyst at realtor.com, explains:“As we move into the spring buying season, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.”The recent drop in mortgage rates is good news if you couldn’t afford to buy a home when they peaked.Home Prices Will IncreaseAccording to the Home Price Expectation Survey, which polls over 100 real estate experts, home values will go up steadily over the next few years after a slight decline this year (see graph below):Rising home prices in the coming years means two things for you as a buyer:Waiting to buy a home could mean it’ll become more expensive to do so.Buying now means the value of your home, and your net worth, will likely grow over time.

Read More

What if a Seller Replaces the Good Stuff?

During a final walk-through, the buyer realized the seller had replaced expensive chandeliers and appliances with cheaper versions. What do they do next? FORT LAUDERDALE, Fla. – Question: We are buying a new home and did our walk-through before the closing. Not only was the fancy chandelier changed for a simple ceiling light, but the high-end washer and dryer had been replaced with well-used basic models. We are distraught. What can we do? – Jon Answer: When people agree to buy and sell a property, they must sign a written agreement. The contract must have the specific terms of the deal, such as timing, price, contingencies, and what is and is not included with the home. Buying property includes the land, the structures built on it, and the appliances and fixtures permanently attached to the structures. This includes things like doors, pool filters, light fixtures and garage openers. Standard real estate contracts include a pre-printed section listing what is included. Most of these lists include kitchen appliances, lights, window treatments, and other fixtures. The contracts also have space to add or exclude specified items. Your first step is to review your purchase contract to ensure the washer, dryer, and chandelier are included. Chandeliers can have sentimental value and are a fixture I often see expressly excluded. If your contract lists these items as included, even, for example, if it lists “appliances” that would include the washer and dryer, it means that the exact item in the home when you sign the contract must be there at closing. It cannot be replaced unless it breaks during the contract term, and then it needs to be replaced with something similar. If the contract lists, for example, the stove, it must be the same stove that was there or a similar replacement, not a lesser model. Similarly, if the dishwasher worked when you signed the contract, it must also work on closing day. After reviewing your contract, you might need to delay closing while the appliances and chandelier are returned or a monetary credit is negotiated. In my law practice, the problems I see usually involve laundry machines, chandeliers and automated pool cleaners, so make sure you address these items when buying or selling if these items are important to you. Copyright © South Florida Sun Sentinel, Gary M. Singer. Distributed by Tribune Content Agency, LLC. All rights reserved.

Read More

Why Aren’t Home Prices Crashing?

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a home. And after several years of rapid price appreciation, home prices finally peaked last summer. These changes led to a rise in headlines saying prices would end up crashing.Even though we’re no longer seeing the buyer frenzy that drove home values up during the pandemic, prices have been relatively flat at the national level. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), doesn’t expect that to change:“[H]ome prices will be steady in most parts of the country with a minor change in the national median home price.”You might think sellers would have to lower prices to attract buyers in today’s market, and that’s part of why some may have been waiting for prices to come crashing down. But there’s another factor at play – low inventory. And according to Yun, that’s limiting just how low prices will go:“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”As you can see in the graph below, we’ve been at or near record-low inventory levels for a few years now.That lack of available homes on the market is putting upward pressure on prices. Bankrate puts it like this:“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”If more homes don’t come to the market, a lack of supply will keep prices from crashing, and, according to industry expert Rick Sharga, inventory isn’t likely to rise significantly this year:“I believe that we’re likely to see low inventory continue to vex the housing market throughout 2023.”Sellers are under no pressure to move since they have plenty of equity right now. That equity acts as a cushion for homeowners, lowering the chances of distressed sales like foreclosures and short sales. And with many homeowners locked into low mortgage rates, that equity cushion isn’t going anywhere soon.With so few homes available for sale today, it’s important to work with a trusted real estate agent who understands your local area and can navigate the current market volatility.

Read More

HOA Fees are Absurd

Read More

![Facts About Closing Costs [INFOGRAPHIC],KCM Crew](https://cdn.chime.me/image/fs/sitebuild/2019929/2/w600_original_7e2aa583-6818-4cc3-a2c4-17c4db55c1d6-jpeg.webp)

Facts About Closing Costs [INFOGRAPHIC]

Read More

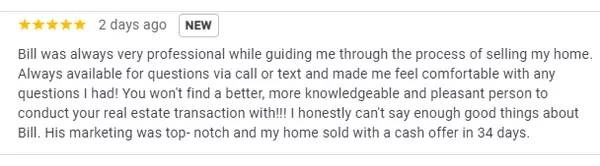

Just Listed in North Port

7910 Jeffery Ave, North Port, Florida Maps & Local Schools Print Click Here to Get Directions $179,900 2bed - 1bath - 7525 sqft lot This charming move-in-ready home is the perfect starter home. Enjoy the terrazzo floors with some covered with other materials ready for a transformation. The enclosed lanai is ready to design with your own special touches. Off the kitchen is an enclosed laundry room extra storage outside help keep your seasonal items dry. The lawn is easy maintenance along with covered parking. The roof is about ten years old. Newer central HVAC and hot water heater. No HOA. Priced to sell and don't wait as this is the only property in the area at this price point. Located near shopping, restaurants, a library, and medical services. North Port is one of the fastest-growing areas in the country. Follow This Home Bill Bambrick Realtor, LPT Realty, LLC 941-218-9961 Licensed In: Florida Contact Me Useful Links North Port Free Home Values

Read More

We’re in a Sellers’ Market. What Does That Mean?

Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today so good if you want to list your house?It starts with the number of homes available for sale. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Today, we have a 2.6-month supply of homes at the current sales pace. Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (see graph below):What Does This Mean for You?When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find one to purchase. That creates increased competition among purchasers and keeps upward pressure on prices. And if buyers know they’re not the only one interested in a home, they’re going to do their best to submit a very attractive offer. As this happens, sellers are positioned to negotiate deals that meet their ideal terms. Lawrence Yun, Chief Economist at NAR, says:“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”Right now, there are still buyers who are ready, willing, and able to purchase a home. If you list your house right now in good condition and at the right price, it could get a lot of attention from competitive buyers.

Read More

Why Buying a North Port Home Is a Sound Decision

If you’re thinking about buying a North Port home, you want to know the decision will be a good one. And for many, that means thinking about what home prices are projected to do in the coming years and how that could impact your investment. The City of North Port has seen fantastic growth over the recent years. Our year-round weather is a major magnet for both retirees and young professionals who now have more flexibility to work remotely. “Another major factor is our local tax environment with no state income tax. North Port ranked third in population growth with a 5.5% increase year over year. The city’s GDP increased 1.3% between 2019 and 2020 – 26th in our study. North Port had the 10th highest employment increase in our study at 7.7% This year, we aren’t seeing home prices fall dramatically. As the year goes on, however, some markets may go up in value while others may lose value. That’s why it’s helpful to keep the long-term view in mind. Experts project a return to a steadier rate of price appreciation in the years that follow. Home Price Appreciation in the Years Ahead Over 100 economists, investment strategists, and housing market analysts were polled by Pulsenomics in their latest quarterly Home Price Expectation Survey (HPES). The report indicates what they believe will happen with home prices over the next five years. As the graph below shows, after mild depreciation this year, these experts forecast home prices will return to more normal levels of appreciation through 2027. The big takeaway is experts aren’t forecasting a drastic fall in home prices nationally, even though some markets will see home price appreciation while others may depreciate. And when they look further out, they see steady price appreciation in the long run. That’s a great example of why homeownership wins over time. What Does This Mean for You? Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. Here’s how a typical home’s value could change over the next few years using the expert price appreciation projections from the survey mentioned above (see graph below): In this example, if you bought a $400,000 home at the beginning of this year and factor in the forecast from the HPES, you could accumulate over $54,000 in household wealth over the next five years. So, if you’re wondering if buying a home is a sound decision, keep in mind what a strong wealth-building tool it is long term. As far as North Port Home sales they still remain a great value, especially for new home buyers! If you want to see how the North Port homes sales looking over the recent months see the monthly reports for North Port Florida.

Read More

Reasons To Consider Condos in Your Venice Home Search

Are you having trouble finding a home that fits your needs and your budget? If so, you should know there’s an option worth considering – condominiums, also known as condos. According to Bankrate: “A condo can be a more affordable entry point to homeownership than a single-family home. And as a homeowner, you’ll build equity over time and have access to tax benefits that a renter wouldn’t.” That’s why expanding your search to include additional housing types, like condominiums, could help you accomplish your homeownership goals this spring, especially if you can be flexible about the space you need. Condos are typically smaller than a single-family home, but that’s part of what can make them more budget-friendly (see graph below): In addition to providing more options in your home search and possibly your price point, there are several other benefits to condo living. They tend to require less upkeep and lower maintenance – and that can give you more time to spend doing the things you enjoy. Plus, since many condos are in or near city centers, they offer the added benefit of being in close proximity to work and leisure. Remember, your first home doesn’t have to be your forever home. The important thing is to get your foot in the door as a homeowner so you can start building wealth in the form of home equity. In time, the equity you develop can fuel a future purchase if your needs change. Ultimately, owning and living in a condo can be a lifestyle choice. And if that appeals to you, they could provide the added options you need in today’s market.

Read More

Look at the Big Picture When it Comes to Home Prices - Video

Read More

What’s Ahead for Sarasota Home Prices in 2023

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could see slight appreciation or depreciation depending on the area of the country. And as we get closer to the spring real estate market, experts are continuing to forecast what they believe will happen with home prices this year and beyond. Selma Hepp, Chief Economist at CoreLogic, says: “While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains. Nevertheless, the continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough.” Additionally, every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts regarding their five-year expectations for future home prices in the United States. Here’s what they said most recently: So, given this information and what experts are saying about home prices, the question you might be asking is: should I buy a home this spring? Here are three reasons you should consider making a move: Buying a home helps you escape the cycle of rising rents. Over the past several decades, the median price of rent has risen consistently. The bottom line is, rent is going up. Homeownership is a hedge against inflation. A key advantage of homeownership is that it’s one of the best hedges against inflation. When you buy a home with a fixed-rate mortgage, you secure your housing payment, so it won’t go up like it would if you rent. Homeownership is a powerful wealth-building tool. The average net worth of a homeowner is $255,000 compared to $6,300 for a renter. Experts are projecting slight price depreciation in the housing market this year, followed by steady appreciation. Given that, you may be wondering if you should move ahead with buying a home this spring. The decision to purchase a home is best made when you do it knowing all the facts and having an expert like Bill Bambrick with LPT Realty on your side. I don't see the Sarasota market home prices falling at all. We are a destination and highly desirable location. Master-planned communities like Lakewood Ranch and Wellen Park in North Port are some of the tops in the country. There are even local pockets where home prices will fall slightly but this is more of a correction due to the extreme bidding wars prior. This is also a limited supply issue as well which is another positive for prices to hold steady.

Read More

Here’s Why the Housing Market Isn’t Going To Crash

Read More

Balancing Your Wants and Needs as a Homebuyer This Spring in Sarasota

Though there are more Sarasota homes for sale now than there were at this time last year, there’s still an undersupply with fewer houses available than in more normal, pre-pandemic years. The Monthly Housing Market Trends Report from realtor.com puts it this way: “While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in 2017 to 2019. This means that there are still fewer homes available to buy on a typical day than there were a few years ago.” The current Sarasota housing shortage has an impact on how you search for a home this spring. With limited options on the market, buyers who consider what’s a necessity versus what’s a nice-to-have will be more successful in their home search. The first step? Get pre-approved for a mortgage. I recommend a local Sarasota mortgage broker as you may get faster and more personalized service. Pre-approval helps you better understand what you can borrow for your home loan, and that plays an important role in how you’ll put your list together. After all, you don’t want to fall in love with a home that’s out of reach. Once you have a good grasp on your budget, the best way to prioritize all the features you want and need in a home is to put together a list. Here’s a great way to think about them before you begin: Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle. Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of these, it’s a contender. Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner. Finally, once you’ve created your list and categorized it in a way that works for you, discuss it with Bill Bambrick with LPT Realty. They’ll be able to help you refine the list further, coach you through the best ways to stick to it, and find a home in your area that meets your needs.

Read More

Categories

- All Blogs (326)

- Aging Parents (2)

- Buyers Tips (36)

- Condos (2)

- Downsizing (7)

- Equity (5)

- Financing/Mortgage (7)

- First Time Home Buyers (7)

- Fun Items (4)

- Home Remodeling (2)

- Investing (4)

- Local Housing Market (32)

- Making Offers (4)

- Moving (2)

- Multigenerational (2)

- New Construction (1)

- North Port Housing Report (3)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Sellers (35)

- Thing to Do in the Area (3)

- Venice Housing Report (1)

Recent Posts

![The Wealth-Building Power of Homeownership [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240608/16/w600_original_2cdc0a73-b6e5-40cb-9980-bd164023d6dc-png.webp)

![Top Reasons To Own a Home [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240601/16/w600_original_b1f8d4ba-4426-4212-8359-03db8a9468cf-jpg.webp)