Appraisal Nightmare? How to Turn a Low Valuation into a Winning Home Deal in Southwest Florida's Shifting 2025 Market

Appraisal Nightmare? How to Turn a Low Valuation into a Winning Home Deal in Southwest Florida's Shifting 2025 Market

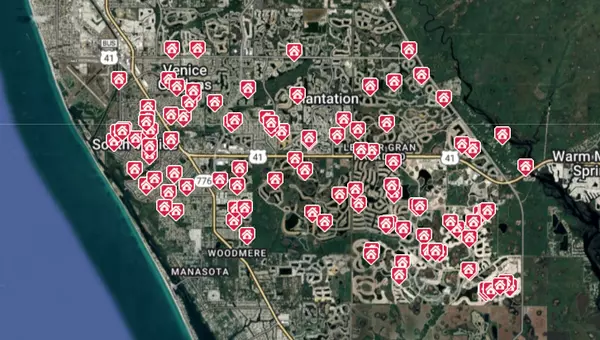

Imagine this: You're days away from closing on your dream single-family home in North Port, Venice, or Englewood, Florida. The excitement is palpable—visions of beachside evenings and Southwest Florida sunsets dancing in your head. Then, the bombshell drops: the appraisal comes in lower than your agreed purchase price. Panic sets in. Will the deal fall through? How does this affect your financing? As a local real estate expert specializing in Southwest Florida's dynamic markets, I've seen this scenario play out more times than I can count, especially in 2025's evolving landscape. But here's the good news—it's not the end of the road. In fact, with smart strategies and a bit of negotiation savvy, you can often salvage—or even improve—your deal. In this post, we'll dive deep into what a low appraisal means for buyers in North Port real estate, Venice FL homes, and Englewood single-family properties, why it's happening more frequently this year, and actionable steps to move forward. Whether you're a first-time buyer or a seasoned investor, my goal is to empower you with knowledge that puts your best interests first.

What Exactly Is a Home Appraisal, and Why Does It Matter in Southwest Florida?

Let's start with the basics to ensure we're on the same page. A home appraisal is an independent evaluation conducted by a licensed appraiser to determine a property's fair market value. Lenders require this to ensure they're not financing more than the home is worth, protecting both you and them from overpaying. In a typical transaction, like the one you might be facing—say, a $330,000 purchase price with $320,000 financed and a $326,000 appraisal—things can get tricky if the value doesn't align.

In Southwest Florida's 2025 housing market, appraisals are under extra scrutiny due to recent shifts. According to regional reports, residential property sales have declined, with single-family home sales dropping 11% from Q1 2024 to Q1 2025 in the broader SWFL area. This cooling trend means appraisers are pulling from a pool of comparable sales (comps) that reflect lower values, often leading to undervaluations. For buyers in North Port FL housing market, where median home prices have fallen 9.8% year-over-year to around $314,543, or Venice FL real estate trends showing an 11.1% drop to $390,875, a low appraisal isn't just frustrating—it's a symptom of a buyer's market emerging after years of heated competition.

I remember working with a client in Englewood last spring whose appraisal came in $15,000 under contract price on a charming single-family home. They felt devastated, but by educating them on their options, we turned it into an opportunity for savings. Empathy is key here: I know how stressful this feels when you're emotionally invested. But knowledge is power, and understanding the "why" behind low appraisals can help you respond effectively.

Common Reasons for Low Appraisals in Florida's 2025 Market

Why does this happen, especially now? Florida's real estate scene, particularly in Southwest Florida, has seen significant changes this year. Inventory is up—homes are lingering on the market longer, with North Port properties averaging 74 days to sell and Venice at 122 days. This surplus, combined with stabilizing interest rates, has led to price corrections. Here are some top culprits for low appraisals, based on industry insights and local trends:

- Declining Market Values: With Florida's median home price dipping to $410,000 in July 2025—a slight decrease from previous months—appraisers are using recent comps that show softening prices. In Englewood FL single-family home market, values are down 13% to $329,073, making it harder for older, higher-priced contracts to appraise out.

- Inaccurate or Outdated Comps: Appraisers might select homes that don't truly match yours—perhaps overlooking upgrades like a new roof or modern amenities. In a fast-changing market like SWFL, where inventory surged 14.5% in Englewood alone earlier this year, comps from even a few months ago can skew low.

- Nearby Foreclosures or Distressed Sales: These pull down neighborhood values. While less common in 2025's stabilizing economy, pockets in North Port have seen price drops over 10% year-over-year due to such influences.

- Poor Property Evaluation: Sometimes, appraisers miss key features, like energy-efficient updates or proximity to Venice beaches. Other factors include overpricing by sellers in a cooling market or external issues like economic uncertainty.

- Regional Specifics: In Florida, hurricane risks and insurance costs can indirectly affect appraisals, as lenders factor in long-term value. With 2025 bringing more inventory to the table, low appraisals are up across the state, challenging buyers to adapt.

If your situation mirrors the example—appraisal at $326,000 on a $330,000 contract with $14,000 in seller credits for roof repairs—note that post-repair value could rise, but lenders focus on current comps.

The Impact: Does a Low Appraisal Derail Your SWFL Dream?

Not necessarily. In your case, with the appraisal above the financed amount ($326,000 vs. $320,000), financing might still proceed, as lenders prioritize the loan-to-value ratio. However, the gap could mean bringing extra cash to closing or renegotiating. Seller credits, like the $14,000 for roof repairs, add nuance—if repairs boost value post-closing, it's a win, but appraisers assess as-is.

In Southwest Florida's 2025 buyer's market, where sales are down 8% year-over-year and prices are softening, low appraisals are occurring in about 15-20% of deals based on local anecdotes. This shift favors buyers, giving you leverage in negotiations for North Port real estate deals or Venice FL home buying processes.

Your Options: Step-by-Step Strategies to Resolve a Low Appraisal

Don't panic—here's a empathetic, educational roadmap tailored to Englewood real estate negotiation and beyond:

- Challenge the Appraisal: Submit a Reconsideration of Value (ROV) to your lender with evidence of better comps or overlooked features. I've helped clients in Venice FL homes boost values by 5-10% this way. Provide data on recent sales or upgrades, like that potential roof value add.

- Renegotiate with the Seller: Ask for a price reduction to match the appraisal, or have them cover the gap via credits. In a market with rising inventory, sellers in North Port FL housing market are more flexible—many agree to avoid relisting.

- Bring More Cash to the Table: If you love the home, cover the difference yourself. For a $4,000 gap (like $330,000 contract minus $326,000 appraisal), it's doable, especially with low down payments.

- Request a Re-Appraisal After Repairs: If credits fund fixes like the roof, time a second appraisal post-work. This works well in SWFL, where home improvements can quickly elevate value.

- Walk Away (As a Last Resort): If no contingency, you risk your earnest money, but in 2025's buyer-friendly climate, better options abound.

Pro Tip: Always include an appraisal contingency in your contract for protection. As your seller's agent advocate, I review these daily to safeguard clients.

Local Insights: Navigating North Port, Venice, and Englewood in 2025

Zooming in: North Port's market shows median prices at $341,000 in July 2025, down 6.3%, with high inventory creating buyer opportunities. In Venice, expect $400,000 medians and longer market times, ideal for negotiating low appraisal fixes. Englewood's single-family homes at $363,000 reflect a 4.5% drop, with 80-day averages—perfect for strategic buyers. Overall, SWFL's third-quarter 2025 report notes 10% median price declines for single-family homes, signaling more low appraisals but empowering negotiations.

FAQs: Quick Answers for SWFL Buyers

- Will it affect us if appraised value is above financed amount? Likely not for approval, but gaps require resolution.

- How long does challenging take? 7-14 days; act fast.

- Anyone dealt with this? Yes—many in 2025's market; outcomes favor prepared buyers.

Final Thoughts: Empowering Your Southwest Florida Journey

A low appraisal doesn't have to shatter your North Port real estate dreams or Venice FL home buying aspirations. In 2025's shifting SWFL housing market, it's an invitation to negotiate smarter and secure better value. As your local expert committed to your best interests, I'm here to guide you through every subtle change—from daily market reviews to fierce advocacy. If you're facing this or planning a move in Englewood single-family homes, reach out for a free consultation. Let's turn challenges into triumphs—your Southwest Florida paradise awaits.

Looking for the best realtor in North Port, Venice, Englewood, Florida, Bill Bambrick with LPT Realty is your top choice for home sellers and buyers.

Categories

- All Blogs (372)

- Aging Parents (2)

- Best Realtor (2)

- Buyers Tips (42)

- Condos (2)

- Downsizing (8)

- Equity (5)

- Financing/Mortgage (8)

- First Time Home Buyers (14)

- Fun Items (5)

- Heron Creek (1)

- Home Remodeling (6)

- homes near golf courses (1)

- Investing (4)

- Living In North Port (4)

- Local Housing Market (49)

- luxury homes (3)

- Making Offers (7)

- Moving (6)

- Multigenerational (5)

- New Construction (3)

- Nokomis Florida (1)

- Nokomis Housing Report (1)

- North Port Florida (3)

- North Port Housing Report (5)

- Pool Homes (2)

- Port Charlotte Florida, (2)

- Probate / Divorce / Foreclosure (1)

- Rent (2)

- Rotunda West (2)

- Sellers (49)

- south gulf cove (1)

- Thing to Do in the Area (7)

- Venice Housing Report (4)

- Venice, Florida (2)

- Waterfront Homes (2)

- Wellen Park (1)

Recent Posts

"Molly's job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "